Let’s talk about money

It’s not easy to talk about money, and particularly difficult to talk about debt. There are two important reasons for making time to talk about these issues, however:

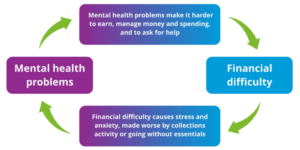

- Financial difficulties can have a negative effect on your mental health, which in turn impacts your ability to address this problem.

- Preventing your financial situation from getting worse.

Better mental health and reduced stress

Mental health and money problems are often intricately linked. Research from the Money and Mental Health Policy Institute shows that in England alone over 1.5 million people are experiencing both debt and mental health problems.

Financial difficulties are likely to cause stress and anxiety and the perception that debt is a bad thing in itself often means that people are reluctant to ask for help, become isolated and are ashamed of admitting that they have debts, let alone asking for help with them.

If you need to cut back on essentials, such as heating and eating, or if creditors are aggressive or insensitive when collecting debts this can compound the sense of shame and reluctance to talk to someone about what’s happening.

Remember, many people across the UK are struggling, especially since the pandemic and the steep rise in the cost of living. Talking about any financial issues is a sign of strength.

Talking to someone about your money worries will help. It’s not easy, but you’ll feel relieved.

So, the first step to dealing with money worries and debt is often, talking about it.

For some people, however debt might not seem like a big issue: credit card minimum repayments are being met every month, the gas/electricity bills are paid and there seems to be enough money for a reasonable standard of living.

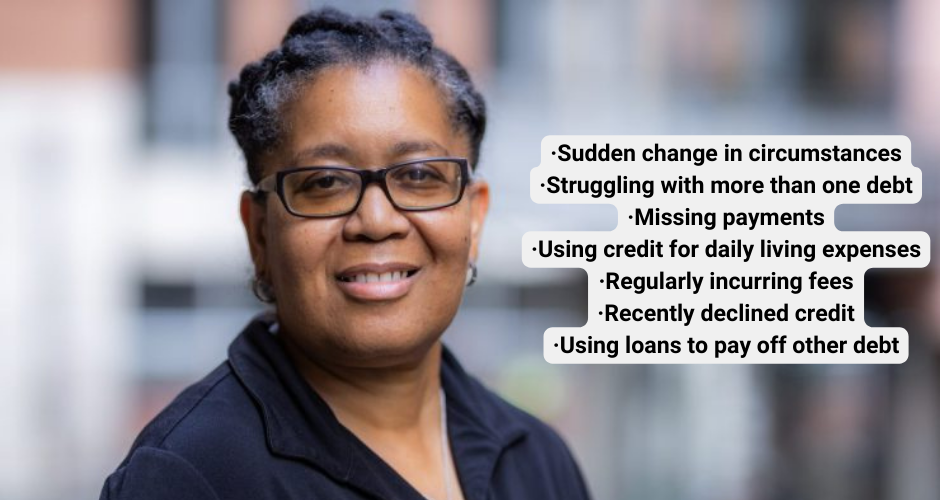

Many people wait more than one year to access debt advice. Even if you think that you are “managing” here are some signs that you might need debt advice:

Taking control of your finances

Where to start:

1. Gather details of your finances

The first place to start getting help with your debts is to gather together all the information about your finances. This can take a little time and it might also feel uncomfortable or frightening if you haven’t ever taken this step.

😊 You’ll need this information, wherever you go for debt advice, though and you’ll only have to go through this process once.

😊 If you have already applied for financial assistance through ABS, you’ll have already done this.

😊 If you’ve already put together a financial statement for debt advice, applying for support through ABS will be quicker, as you’ll have all the information in one place.

Gathering information and putting together a budget is something that you’ll most likely only need to do once before seeking support.

The sooner you seek help and advice, the better. According to the national charity, StepChange, 92% of their clients wish they had asked for help earlier.

2. Use an online budgeting tool to draw together this information.

It might help to make some notes first and check back through your paperwork (bank statements, bills, wage slips etc). The following categories are essential elements of the budget:

- Income – benefits, wages, interest from savings, money from lodgers.

- Outgoings – each month such as rent, utilities, food, housekeeping and travel costs.

- Debts – including credit cards, loans, and arrears on any bills such a water, electricity or gas.

- Assets – this would include a house (or any other property) or a car. Give their estimated value.

- Examples: StepChange and Money Helper offer good options for budgeting tools.

You may see PRIORITY DEBTS and NON-PRIORITY DEBTS on budgets.

It’s always tempting to keep up repayments for credit cards and personal loans, at the expense of other financial commitments. This might be because you are receiving phone calls, emails etc. from lenders, putting pressure on you to make a payment. However, it’s important to know the difference when talking about debt.

Priority debts and bills are those that can:

- Impact on your home and health

- Cause legal problems

- Lead to more debt

Always pay these first.

Priority bills can be different based on where you are in the UK. See here for lists for priority bills in England and Wales, Scotland and Northern Ireland. You will also find more information on priority debts and bills.

3. Get Help

Here at ABS our Welfare Caseworkers can:

✔️Talk to you about your financial situation in general, as well as the money that you owe.

✔️ Offer support with money management as part of our financial assessment and support service.

✔️ Support you to maximise your income through a referral to one of our experienced Welfare Benefits Advisors, who will be able to check that you are receiving all benefits to which you might be entitled.

✔️Refer you to StepChange. We can provide additional support to help you get started and take the first step towards getting debt advice.

❌ We can’t provide money advice as this is what is known as a regulated activity. Only organisations with the relevant permissions from the Financial Conduct Authority.

We have a partnership with StepChange which is the UKs largest provide of genuinely free independent debt advice and managed solutions.

- 25 years experience

- Completely free and impartial service

- Can give extra support if needed

- Offer access to the broadest range of debt solutions

Get started here

StepChange can also be contacted by telephone if you need to speak to one of their advisors? Contact them on 0800 138 1111. Monday to Friday 8am to 8pm and Saturday 9am to 2pm.

Business debts

If you are self-employed or run a small business and have personal or business debts, contact the free advice service in your area: Business Debtline (England and Wales), Business Debtline (Scotland) or Advice NI Business Debt Service (Northern Ireland).

Other sources of advice and help:

There are lots of free advice services across the UK, and you can search for them here:

You can search by method of delivery (online, face-to-face, telephone), country (UK nations) and geographical location.

❗ You don’t need to pay for debt advice.

❗ Check that the organisation is registered with the Financial Conduct Authority.

Look for this: