Over the coming months we are aware of a number key dates that may affect your circumstances.

Our welfare team are here to offer advice and help in as many ways as we can. Get more on our support services here.

Following the Chancellor’s announcement on 3rd March we have updated the below to reflect this.

The £20 a week Universal Credit and Working Tax Credit uplift to continue to end to September 2021

Last year the Government increased Universal Credit and Working Tax Credit by £20 a week in response to the coronavirus pandemic. This increase is now set to continue until the end of September 2021, as announced by the Chancellor in his budget on 3 March. Unprecedented numbers of people have had to claim UC for the first time during the pandemic. The £20 a week increase has been a lifeline to many individuals and families.

“£20 per week represents 13% of an average recipient’s monthly UC entitlement, and for some families the figure will be as high as 21%.” – ifs.org.uk.

Those claiming Working Tax Credit will also get equivalent support for a further six months. Working Tax Credit these claimants won’t get a weekly payment but will instead get a one-off payment of £500.

Universal Credit & the Minimum Income Floor (MIF): MIF suspension due to end

One of the measures brought in because of the impacts of the coronavirus outbreak was to suspend the MIF policy for Universal Credit claimants who are registered as self-employed. This means that self-employed claimants currently have their Universal Credit award amount calculated on their actual real income (or lack of) rather than being seen as having a notional income added to the calculation which determines their monthly Universal Credit benefit entitlement.

The budget on 3 March noted the continued suspension of the MIF until the end of July 2021. The MIF then will be gradually reintroduced from August, but DWP work coaches will be given discretion to not apply it on an individual basis where they assess that claimants’ earnings continue to be affected by COVID-19 restrictions.

If you are thinking of applying for Universal Credit as a self-employed person, we would recommend that you speak to one of our Welfare Officers.

Furlough Scheme extended to the end of September 2021

The Furlough Scheme, was launched on 20 April 2020 and is now due to continue to the end of September 2021, as announced by the Chancellor in his budget on 3 March 2021.

Employees on furlough will get 80% of their salary, up to £2,500 a month, paid by the state – employers need to cover pension and national insurance contributions.

Between now and 30 June, the state will pay 80% of wages for hours not worked, up to £2,500 a month, and employers will only be asked to cover national insurance and employer pension contributions. But in July the state will only pay 70%, with employers expected to pay the remaining 10%, and in August and September the state will pay 60% and employers will have to pay 20%.

To qualify for the current round of furlough support an employee needs to have been on an employer’s PAYE payroll on or before 30 October 2020. Click here for more information.

Self-Employment Income Support Scheme (SEISS)

• The fourth SEISS grant will now be worth 80% of trading profits for three months ( February, March & April), capped at £7,500.

• Applications for the fourth SEISS grant will open sometime in April.

• While previously one must have filed a tax return for 2018/19 to apply, the Government now says those who’ve filed a 2019/20 return may also be eligible.

• A fifth self-employed grant has also been announced, the final SEISS grant, covering May to September. The final grant can be claimed from late July.

See here for further details.

*Not all self-employed people can get the SEISS grant – for example, earnings are more than £50,000 a year, or if less than half of income is from self-employment.

Get Help

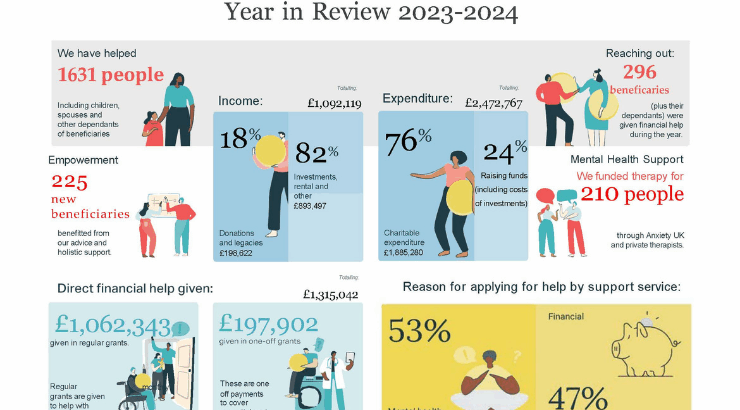

We are here to support the architectural community; those who have had one year’s professional experience in the UK in architecture, architectural technology or landscape architecture, and their families.

Explore